It was another volatile day of trading for Spain's top-flight index, with the benchmark gauge weighed down by the fallout from Turkey's currency crisis and retreating 1.26% to 9,386 to stand just a hair's breadth away from the year-to-date lows that it hit back in March.

- 10.729,500

- -0,33%

Steel stocks were at the bottom of the pile, with shares of ArcelorMittal erasing 4.6% and those of Acerinox another 3.2%, with just a handful of issues managing to stay in the black.

BBVA was again in the spotlight, with its shares down 0.99% at 5.39 euros, taking its losses for the year - and since last Friday - to 10%, despite assurances from management that its exposure to Turkey is limited.

Técnicas Reunidas and Mapfre were also trading on the back foot, given how they derive 5.3% and 3.0% of their sales from their Mediterranean neighbour, with stock in the former slipping 2.6% and that of the insurer by 2.16%.

| Más suben Ibex 35 | |||

|---|---|---|---|

| SIEM GAM REN EN | 11,88€ | 0,05 | 0,42% |

| INDRA SISTEMAS ... | 10,46€ | 0,01 | 0,10% |

| Mediaset Españ... | 6,27€ | -0,00 | -0,03% |

| MERLIN PROP. | 11,90€ | -0,02 | -0,13% |

| Melia Hotels | 10,73€ | -0,02 | -0,19% |

| Más bajan Ibex 35 | |||

| ARCELORMITTAL | 24,73€ | -1,37 | -5,25% |

| ACERINOX | 11,89€ | -0,45 | -3,65% |

| TECNICAS REUNID... | 27,26€ | -0,84 | -2,99% |

| Repsol | 16,12€ | -0,44 | -2,63% |

| ACS | 35,36€ | -0,94 | -2,59% |

Naturally, Turkey's currency, the lira, was very much in the headlines, even as it managed to extend its rally versus the US dollar after Ankara moved to make it costlier for speculators to short the country's currency, sending the lira 6% higher. Markets are breathing a sigh of relief but traders remain on edge, mindful of the challenges the country now faces. Indeed, given Turkish officials unwillingness to condone a rate hike, some analysts - albeit not all - believe further currency weakness is on the cards.

On a more positive note, Robin Brooks, the International Institute for Finance's chief economist, reportedly said 'fair value' for the lira was nearer to 5.0 to 5.5.

Brooks reportedly also forecast the currency would strengthen over the next year or two, as the economy slowed, but exports improved, boosting the country's balance of payments.

Thus, only three of Madrid's blue chips managed to eke out a positive close. Siemens Gamesa notched up a gain of 0.63%, although at one point in Wednesday's session it was 2% ahead, tracking gains in Danish peer Vestas on the back of its latest quarterly numbers. Its net profits fell, but investors cheered a growing order book for its wind turbines. For the year, the wind-turbine maker is ahead by 4.55%, putting it in the upper rungs of the Ibex 35's leaderboard for 2018.

Mediaset was also wanted, with its shares adding 0.22% while Indra gained 0.19%. On the other side of the ledger, lenders' shares were especially weak, with those of Bankinter giving back 2.66% and Santander's down 2.0%.

TURKEY IN CRISIS

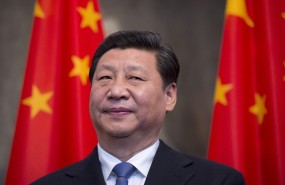

Investors are hoping that Turkish President Recep Tayyip Erdogan will relent and allow the monetary authority to raise rates, as many market participants are clamouring for, despite his well-known antipathy to tighter policy. But instead, over the past few days he has chosen to avoid the issue, asking citizens for help in propping up their currency while saying that he will persecute the "economic terrorists" whom he claims are behind the fall in the lira's value. Indeed, he has gone as far as threatening to boycott US-made electronic goods, even as he hiked tariffs on American cars, alcohol and tobacco.

As well, on Wednesday he halved the amount of FX swaps that the country's lenders can enter into with foreign banks, in order to make it more expensive for foreign speculators to short the currency, helping, for the time being at least, to boost the value of the lira.

Nevertheless, with real or inflation-adjusted interest rates currently near zero, almost all analysts agree that the most prudent course of action for the country would be to hike interest rates, despite the toll that it might take on economic growth over the short-term .

But Erdogan refuses to yield, blocking any move by the central bank to hike rates, thus unwittingly adding to the negative feedback loop in markets.

OTHER MARKETS

The Continent's other main bourses were similar weak, with Paris's CAC 40 falling 1.82%, the Dax off by 1.6% and the FTSE 100 dropping 1.5%. Stockmarkets in Austria, Italy and Greece remained closed for trading. In Spain and France it was a bank holiday. Over on Wall Street meanwhile, shares were reeling.

Asian stocks also finished lower overnight, ending the day at their worst level in a year, with Japan's Nikkei-225 retreating 0.68%, while China's CSI 300 surrendered 1.8% and Hong Kong 's Hang Seng fell 1.5%.

Weighing on Chinese shares, and those in the wider region, are the increased signs that Beijing is straining to meet its growth targets. even as the ongoing trad spat with the US shows little sign of easing.

A steep 3.5% decline in crude oil futures on the heels of the latest weekly US inventory data in the States was adding to the negative tone in markets. West Texas Intermediate for prompt month delivery was down by 3.62% to $70.34 per barrel.

Meanwhile, the euro was falling 0.25% against the US dollar and changing hands at 1.1319.

TECHNICAL ANALYSIS

Today's bank holiday may turn out to have been decisive, with the Ibex 35 having lost its grip on an area of technical support at 9.470. If confirmed on weekly price charts, the benchmark gauge may fall back into a bear trend with the 9.300-9.350 point area as its next port of call, which if lost may signal an eventual move down towards the 8.500 point area.

Noticias relacionadas

Los grandes analistas quitan hierro a la crisis turca y descartan el contagio

BBVA, DIA y Mediaset, de los valores del Ibex más vendidos por los fondos

Algunos gurús alertan del "mayor 'default' de la historia" en Turquía

Las bolsas asiáticas caen a su nivel más bajo en un año