- Bad behavior from the Basque bank, pressured by the instability in Turkey

The Ibex 35 closed almost flat (+ 0.08%, 9,754.60 points). The rises of Inditex, CaixaBank and Bankia have not been enough to offset the declines recorded by other large companies such as BBVA, Santander, Telefónica and Repsol. On another typical summer day, with little negotiated volume, the Spanish has continued to list flat.

- 11.154,600

- 1,56%

Within the selective DIA, once again is the 'red lantern'. The supermarket chain, which capital is controlled by more than 18% by bearish investors, continues to make great efforts not to lose 2 euros per share, although it has dropped 2.09% to 2,016 euros, followed by Técnicas Reunidas ( -1.09%).

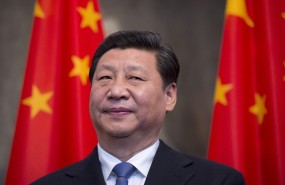

Although the real burden for the Ibex has been BBVA, which has yielded 0.92% due to the instability between the United States and Turkey. The Turkish lira has set a new historical minimum while the delegation of Turkish diplomats who have traveled to the US have refused to get the American priest out of prison. His incarceration is what has caused the current diplomatic crisis between both countries.

Other large stocks have not performed well either, especially Santander (-0.56%), Telefónica (-0.47%), Repsol (-0.38%) and Iberdrola (-0.33%). On a positive note, the most bullish value was Siemens Gamesa (+ 1.98%), although the big 'engine' of the Ibex was Inditex, which was up 1.85%, followed by Viscofan (+ 1.24% ) and Colonial (+ 1.04%).

In the main board, the main protagonists were Berkeley Energía and Prisa. In the case of the mining company, which had plummeted by 51% in the previous session, this Thursday it has rebounded by 50%. An amazing volatility in a value that just debuted on the market. For its part, the communication group has shot up 10%. In addition, Coca Cola European Partners has risen 4% after posting good results.

OTHER REFERENCES

On the European corporate front, Swedish retailer Ikea opens its first store in India on Thursday. And, as far as results, today Adidas, the great protagonist in the German Dax30 after rising in value 9%.

In Asia, the Chinese stock exchanges have registered a rise of 1% after the CPI of China in July has marked a maximum of four months after rising 2.1% year-on-year.

At the political level, the different actions of the USA have made the news. Along with the sanctions on Iran, Washington has announced that it will punish Russia with sanctions for the alleged participation of the Kremlin in the attack on former Russian spy Sergei Skripal in Salisbury, England. According to the spokeswoman of the Department of State, Heather Nauert, the sanctions will come into effect around August 22.

In the currency market, the euro depreciates 0.35% in its cross against the dollar, up to $ 1.1569. And when it comes to raw materials, Brent oil yields 0.1%, up to $ 72.20.

TECHNICAL ANALYSIS OF THE IBEX 35

As for the Spanish selective, it remains embedded between the 9,500 points and 10,000 points and seems to be very comfortable within these levels. So far this summer, the index has shown that it intends to continue moving within a very narrow range and not give excessive scares.

"We must wait for the price to confirm in weekly candles above the resistance of 10,050 points (top of the triangle) or to drill the base of the same, now at 9,470 points, and act accordingly, adopting longs ( bullish positions) or shorts (bearish positions), respectively ", comments José María Rodríguez, analyst at Bolsamanía.

Noticias relacionadas

Los rumores dominan DIA: de la OPA a la especulación de los insiders

El riesgo de impago de la deuda de Turquía se dispara un 110%

Wall Street cierra en signo mixto: el Nasdaq y el S&P 500 se acercan a máximos

azValor sale de Telefónica y lleva la contraria a los grandes gestores value