The Ibex and the rest of European markets are betting on the extension of the hikes this Tuesday, when there are two days until the end of the year. Wall Street opted for the rises this Monday, like the indices of the Old Continent, after Donald Trump finally decided to support the stimulus plan, but on the condition that the citizen aid checks would become $2,000 instead of the $600 originally approved.

- 11.299,300

- -0,56%

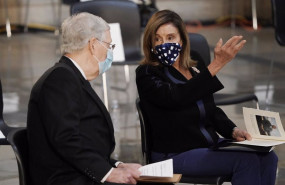

The US House of Representatives voted Monday in favor of this increase in the second round of federal direct payments to $ 2,000 by 275 votes in favor and 134 against. Now everything is in the hands of the Senate. A spokesman for Senate Majority Leader Mitch McConnell did not immediately respond to a request to comment on whether the Senate would vote on the bill passed by the House, CNBC reports. In a statement Sunday, applauding Trump's decision to approve the aid plan, McConnell did not mention any plans to vote on a payment increase.

Also on the other side of the Atlantic, it is news that the Donald Trump Administration has strengthened on Monday the executive order that prohibits US investors from buying securities of Chinese companies allegedly controlled by the Chinese military. The Treasury Department has released guidance clarifying that the executive order, published in November, will apply to exchange-traded funds and index funds, as well as to subsidiaries of Chinese companies designated as owned or controlled by the Chinese military.

On the other hand, the EU and China are about to agree on a major investment agreement that will set the rules of the game for the trade relations of both economic powers amid the reluctance of Joe Biden. The deal could close this week.

All in all, the European indices opt for the advances while the American futures come with increases of 0.4% on average. Meanwhile, Asia has experienced a day with a clear predominance of the green numbers, with Tokyo marking the highest since 1990 (+ 2.6%).

The agenda for this Tuesday includes, among other things, the appearance in Spain of the Prime Minister, Pedro Sánchez, to take stock of the year. In addition, at the business level, Unicaja and Liberbank meet their boards to, predictably, approve their merger, and MásMóvil holds an extraordinary meeting in which the board's proposal to acquire the shares that are currently in the hands of minority shareholders will be analyzed. price of 22.5 euros offered in the recent takeover bid.

As for the technical aspect of the Ibex, the selective tries to leave behind the level of 8,200. The experts at Bolsamanía explain that we must be attentive to these prices since, if they exceed them, we could end up seeing an extension of the gains until the key resistance of 8,322 points. "If it managed to exceed these prices, we could end up witnessing an extension of the increases to the level of 8,639 points. The first level of support is at 7,663 points," explains César Nuez, analyst at Bolsamanía and head of Trader Watch.

Noticias relacionadas

Wall Street apuesta por el verde con el Dow y Apple en nuevos máximos gracias a Trump

La Cámara de Representantes de EEUU vota subir las ayudas directas a 2.000 dólares

La Unión Europea y China podrían cerrar su acuerdo de inversión esta misma semana