The Ibex has increased (+ 0.87%. 9,204 points) boosted by the rises in banks (BBVA, CaixaBank, Sabadell, Santander ...). The index thus closes the sixth consecutive week of gains. The stocks maintain the good tone, but with a high dose of uncertainty. There are elements that generate tension, such as inflation, and that is why the rises are combined with setbacks and a certain amount of instability.

- 11.154,600

- 1,56%

Within the Spanish index, the steep falls in Indra (-7.69%) Pharmamar (close to 4%) and Almirall (-1.06%) stand out. On the positive side, in addition to banks, IAG or Mapfre have risen notably.

Indra has collapsed on the floor after it became known that the Government has dismissed its president Abril-Martorell, a fact that the company itself has confirmed.

The stock markets of the Old Continent are calm, therefore, at the end of the week, after yesterday Wall Street closed with notable increases (Dow Jones: + 0.55%; S&P: + 1.06%; Nasdaq: +1, 77%), while in Asia the session ended with a mixed sign.

Investors today are closely following May's preliminary manufacturing and services PMIs released in Europe and the United States. In the Euro Zone, the flash of the PMI composite index of total activity stood at 56.9 compared to the previous figure of 53.8, reaching its maximum in the last thirty-nine months. The manufacturing PMI stood at 62.8 (below the previous 62.9 but above the 62.5 estimates), while the services PMI stood at 55.1, above the previous data and the estimate of 52.3.

In Japan, the manufacturing PMI showed a weakness in May from the previous month (52.5 from 53.6), while the services PMI fell to 45.7 from 48.3.

"The collapse of the Japanese services PMI was the biggest drop since the first state of emergency last April and left the index at its lowest level in nine months," says Marcel Thieliant of Capital Economics.

As for the rest, this Friday the data for weekly unemployment claims in the US continues to kick in, which fell to 444,000 from 478,000 the previous week and compared to the 452,000 expected.

The calendar for this last trading day includes retail sales in the United Kingdom, which shot up 9.2% in April, while the Eurogroup meets today in Lisbon to discuss the economic and fiscal situation.

FEARS OF INFLATION DECREASE

This week the fear of an increase in inflation has also been present in the markets, but it is true that it has been weaker. Oanda expert Jeffrey Halley says inflation fears are waning, allowing equity markets to resume their rally.

"I don't think the inflation story is over, but I do accept that it may be over for now. It will come back, but of one thing I'm sure, we still don't know if it will be temporary or fixed. My hunch is the former, but I have an enough open mind to allow the second, "he says.

THE BITCOIN RECOVERES THE 40,000

Bitcoin ends a very difficult week, in which it sank 30%, above $ 40,000 ($ 41,128, + 2.36%). The US Treasury Department announced on Thursday that it will strengthen surveillance on cryptocurrencies such as bitcoin, considering that they "facilitate" illegal activities, such as tax evasion, and will require that transactions of more than $ 10,000 be reported to the US Treasury .

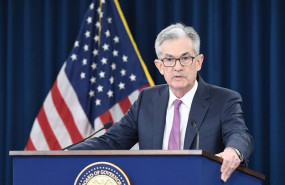

For his part, the president of the Federal Reserve (Fed), Jerome Powell, also announced this Thursday, through a video, that the US is making progress in the development of its own digital currency and announced that this summer they will publish a specific report on the pros and cons it will have for the economy and finances.

Powell referenced the growing popularity of digital currencies like bitcoin, stating that they remain inefficient payment mechanisms.

Ethereum is now down 1.55% to $ 2,755.

OTHER MARKETS

The euro trades at $ 1.2231. Brent oil rises to $ 66.09. West Texas is flat.

Gold and silver fell moderately to $ 1,879 and $ 27.93, respectively.

The yield on the 10-year American bond stands at 1,634%.

Noticias relacionadas

Todo en orden en Wall Street: el Nasdaq borra las pérdidas de las últimas tres sesiones

Las peticiones semanales de desempleo caen en EEUU, hasta las 444.000

La Fed publicará un informe que examinará la posibilidad de lanzar una divisa digital